Employee benefits are very important to many. Sometimes they can determine whether potential employees will accept your offer and work for you instead of going to your competitors.

There are two types of employee benefits: those the employer has to provide by law and optional benefits a business owner may decide to offer their employees in order to motivate them to stay. Among the required benefits there are social security and workers’ compensation. Optional benefits may include various things such as medical insurance coverage and retirement benefits. Regardless their type, all these benefits may have tax and legal implications for the business owner.

This is a brief overview of the employee benefits required by law and their implications for the employer.

Social Security Tax

The employer has to pay Social Security tax in an amount equal to the one paid by the employee.

In order for you to learn what you need to do to comply with the legal requirements, you can visit these websites:

- Information and Resources for Employers

- Social Security: Business Services Online

- Employer W-2 Filling Instructions and Information

- Instructions for Hiring Employees Not Covered by Social Security

Unemployment Insurance

If your business hires employees, you may need to pay unemployment insurance taxes. For this, it is mandatory that you register with your local workforce agency. You can find it on our State and Local Tax page.

Workers’ Compensation

Companies with employees must provide Workers’ Compensation Insurance coverage through a commercial agency or through the state Workers’ Compensation Insurance program. It is also possible to choose the self-insured option. Anyway, you can visit the Workers’ Compensation page for more information on this issue.

Disability Insurance

Partial wage replacement insurance coverage is mandatory in the following states:

If your business is registered in any of the above mentioned states, you must provide this type of insurance to your eligible employees.

Leave Benefits

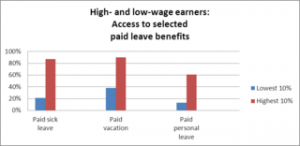

Most leave benefits are optional and they can be offered as part of the employer’s overall compensation and benefits plan. They include but aren’t limited to vacation jury duty, sick leave, personal leave and funeral or bereavement leave. Nonetheless, it’s mandatory for businesses to offer leave under the Family and Medical Leave Act (FMLA).

Family And Medical Leave

According to The FMLA, employees can have maximum 12 weeks of unpaid leave within a 12 months period in any of the following situations:

– Child birth and care or child adoption

– Care of an immediate family member is case of severe health problems

– Care of the employee in case of serious health problems

FMLA requires employers to maintain the benefits for the entire duration of the leave, just as if the employee continued to work normally. It applies to all employees in public administration as well as to employees of companies with more than 50 people. You can find more information on the Department of Labor’s official website.